Listen up, Men! The poor stay poor by saving… here’s what the rich do.

Here’s a harsh reality you need to grasp: poor people save money, while rich people invest it. The difference between these two mindsets is why the rich get richer and the poor stay stuck in the same financial rut. If you want to elevate your life, stop thinking like a saver and start thinking like an investor. Let me break it down.

The Truth About Saving Money

Saving money sounds wise, right? Wrong—if that’s all you do. The money you stash away in your bank account loses value over time because of inflation. That’s right—your Naira, Dollar, or Pound is depreciating every single day. By the time you go back to withdraw it, it buys less than it did when you saved it.

Meanwhile, the banks aren’t just sitting on your money. They’re using it to fund loans for businesses, mortgages, and investments. In other words, your savings are helping the rich build wealth while you earn a measly interest rate that doesn’t even beat inflation. You’re literally making them richer while your money shrinks in value.

The Power of Investing

Rich people don’t hoard cash—they make their money work for them. They invest in assets like real estate, stocks, bonds, businesses, and more. These investments appreciate over time, generating income and increasing their net worth year after year. While the saver’s money is losing value, the investor’s money is compounding, multiplying, and creating generational wealth.

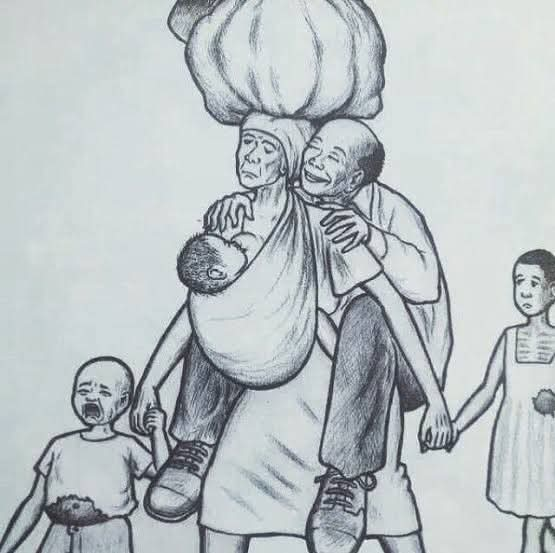

Why the Rich Don’t Want You to Know This

Here’s the game: the rich rely on the poor and middle class to keep saving. They need your savings to fund their investments. Every time you deposit money into the bank, you’re indirectly helping the wealthy expand their empires. They don’t teach you this because the system benefits from your ignorance. The less you know, the easier it is to exploit you.

What You Should Do

1. Start Thinking Like an Investor

If you want to break out of the cycle of poverty, you need to shift your mindset. Saving is just the first step. The next step is learning how to invest wisely. Your money should be growing, not sitting idle.

2. Learn Financial Literacy

Educate yourself. Read books like Rich Dad Poor Dad by Robert Kiyosaki, The Intelligent Investor by Benjamin Graham, or Think and Grow Rich by Napoleon Hill. The more you understand about money, the harder it is for the system to take advantage of you.

3. Invest in Assets, Not Liabilities

Stop spending your money on things that don’t make you money. Instead of buying a car that depreciates, invest in something like rental property or dividend-paying stocks that generate income.

4. Focus on Long-Term Growth

Rich people understand the power of patience. Investments take time to grow, but the payoff is worth it. Stop looking for quick money schemes and start building wealth that lasts.

Final Word

The choice is yours: keep saving money and watch it lose value, or start investing and watch it grow. The rich are playing chess while the poor are stuck playing checkers. It’s time to wake up, learn the rules, and start playing the game to win.

Don’t let your ignorance fund someone else’s wealth. Be passionate let’s, builds, and thrives.