Listen up, Men! Understand assets vs liability.

Your success, freedom, and legacy will be determined by one thing: your understanding of assets and liabilities. If you don’t grasp this fundamental truth, you’re setting yourself up to be a slave to money, debt, and shallow appearances for the rest of your life. Real wealth isn’t about how much you spend—it’s about what you build. Stop throwing money at liabilities to impress people who don’t care about you. It’s time to delay gratification, invest wisely, and focus on long-term gains instead of short-term flash.

An asset puts money into your pocket; a liability takes it out. This isn’t rocket science, yet too many men waste their income buying things that drain their wallets just to look successful. You’ve seen it: the guy who makes average money but buys a luxury car he can’t afford, drowning in debt to keep up appearances. He spends his days stressing about payments while his so-called friends applaud his “success.” Guess what? When his finances collapse, those same friends won’t lift a finger to help him. Stop being that man.

The solution is simple: invest in assets that make you money. For example, instead of blowing your savings on a flashy GLK that will bleed you dry with maintenance costs, buy a truck that generates income. That truck could power a logistics business, earn you contracts, or open doors to opportunities. While others are busy impressing their Instagram followers, you’re building wealth that lasts. You don’t need to look rich today; you need to be rich tomorrow.

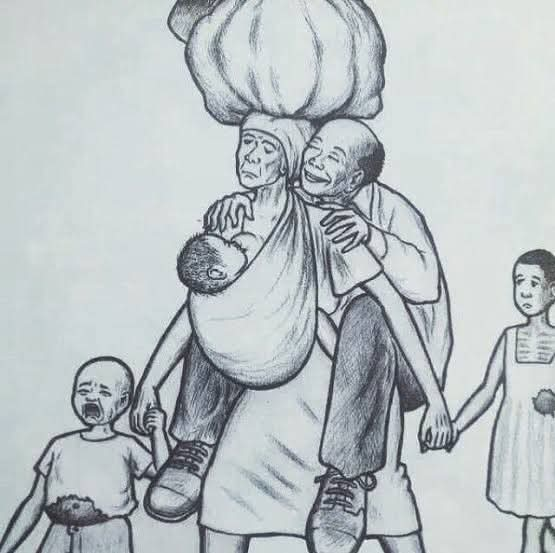

This principle doesn’t stop at material possessions—it applies to the people you allow in your life, too. The woman you choose to partner with can either be your greatest asset or your most destructive liability. A smart, financially prudent woman will help you grow your wealth and amplify your success. She’ll respect your vision, encourage your financial discipline, and build with you. This is the type of woman who understands the value of patience and delayed gratification, who doesn’t need shiny things to feel secure. Together, you’ll create a legacy.

On the flip side, a fake high-maintenance woman will drain your resources faster than any liability ever could. She’ll demand luxury you can’t afford, disrespect your money, and have no concept of financial intelligence. You’ll spend your life trying to fund her shallow lifestyle while sacrificing your dreams and investments. When the money dries up, she’ll leave you for someone else. A woman like this isn’t just a liability—she’s a financial catastrophe. Choose wisely, because the wrong woman will cost you everything.

The key to escaping this trap is delayed gratification. Weak men chase instant gratification: the fancy cars, designer clothes, and flashy gadgets. Strong men understand that short-term sacrifices lead to long-term success. Drive a modest car today so you can afford fleets tomorrow. Live within your means now so you can live above them later. Stop trying to impress people who bring zero value to your life. Your real friends won’t care about your car or your watch; they’ll care about your growth, your discipline, and your vision.

If you want to secure your future, you need to start making smarter financial decisions today. Begin by tracking every naira you earn and spend. Understand where your money is going and cut out unnecessary expenses. Redirect that money into income-generating assets like rental properties, stocks, small businesses, or even that Mercedes truck that pays for itself. Every naira invested in an asset is a step toward financial independence. Every naira wasted on a liability is a step backward.

Educate yourself. If you don’t understand money, it will control you. Read books like Rich Dad Poor Dad by Robert Kiyosaki to learn the basics of building assets. Dive into The Intelligent Investor by Benjamin Graham to understand how to grow your wealth. Internalize the principles of Think and Grow Rich by Napoleon Hill to develop the mindset of success. Knowledge is power, and ignorance is a guaranteed ticket to poverty.

Most importantly, evaluate the people you surround yourself with—especially the woman in your life. A good woman who supports your financial discipline is an irreplaceable asset. She’ll help you save, invest, and build a future. But a woman who constantly demands more than you can give, who disrespects your money, or who pressures you to spend recklessly will be your downfall. Don’t let lust blind you to a woman’s character. A partner who builds with you is worth more than gold. A partner who drains you isn’t worth a dime.

Men, your success is in your hands. Understand the difference between assets and liabilities. Invest in things that bring long-term value to your life. Choose a woman who respects your money, your goals, and your grind. Delay gratification and focus on building wealth, not displaying it. Stop living for approval from people who don’t matter, and start building a future that does.

The Code Is Simple:

• Understand assets and liabilities.

• Delay gratification.

• Invest in your future.

• Choose your partner wisely.

Stop chasing validation, start chasing greatness, and watch your life transform.